Article - Different types of Property Tax in Malaysia

Property taxes are a certainty that all property owners must face.

There are taxes for every step of the way- during the purchase of

property, owning of property and of course, the selling (or

transferring) of property.

This

simple guide aims to give property owners a better idea of what are the

most common taxes, under what circumstances they apply as well as how

to calculate them throughout the different stages of buying, owning to

the letting go of property.

Purchasing a Property

1. Stamp Duty

During the purchase of a property, there is a ton of paper work

involved, which is already quite overwhelming in itself. Stamp duty

makes things a little more complicated (and costly) to purchase a

property.

Stamp duty is imposed on the ‘instrument of transfer’

(or documents) related to the purchase or transfer of the property,

which is paid for by the buyer. These include the Sales and Purchase

Agreement (S&P) and Memorandum of Transfer (MOT), and even loan

documents.

The Inland Revenue Board stipulates that the amount of

stamp duty is levied upon the value of the property, determined by

(whichever higher):

(i) The property’s market value.

(ii) The property’s selling price.

(ii) The property’s selling price.

Example:

Property price based on market value: RM600,000

Property price based on selling price: RM550,000

Property price based on selling price: RM550,000

So the amount that stamp duty will be levied on is RM600,000 (the higher amount of the two).

Calculating stamp duty:

Based on the example of a property valued at RM600,000:

*Note: Stamp duty is also imposed on

the documents of loans taken to purchase properties. If you take a loan

to purchase the property, you will have to pay 0.5% of the loan amount

on top of that.

2. Goods and Services Tax (GST) - Commercial Properties

GST is a fixed 6% tax imposed on goods and services in Malaysia

beginning from 1st April 2015. In terms of property purchasing, GST of

6% is applicable when you (buyer) purchase a commercial property from an

individual who is GST-registered.

Criteria of commercial property owners who have to be GST-registered:

(i) Own 2 or more commercial properties.

(ii) Own land larger than 1 acre.

(iii) Own a commercial property/land valued at more than RM2 million (based on market price).

(iv) Earn more than RM500,000 (total annual taxable supply) from the commercial properties owned (eg: renting).

(ii) Own land larger than 1 acre.

(iii) Own a commercial property/land valued at more than RM2 million (based on market price).

(iv) Earn more than RM500,000 (total annual taxable supply) from the commercial properties owned (eg: renting).

For instance:

The

seller is a GST-registered individual whom you intend to purchase a

shop lot from at a price of RM500,000. GST of 6% will then be charged to

that amount (RM500,000), which you (buyer) will have to pay.

Owning a Property

After

going through the daunting task of applying for a loan, purchasing the

property and paying the applicable taxes, you are now the proud owner of

a property! But what’s next? Well for starters, more taxes of course.

3. Cukai Taksiran/Cukai Pintu (Property Assessment Tax)

The property assessment tax, better known as Cukai

Taksiran/Cukai Pintu, is a tax imposed on every household to finance the

maintenance and construction efforts of various public infrastructure

around the neighbourhood, town or city where the property is located.

These

include the costs of cleaning and maintaining drains, road works to

repair potholes, replacing broken street lamps and so on. The tax is

payable to the local council of the area in which your property is

based, such as Dewan Bandaraya Kuala Lumpur (DBKL), Majlis Bandaraya

Petaling Jaya (MBPJ), Majlis Bandaraya Ipoh (MBI) etc..

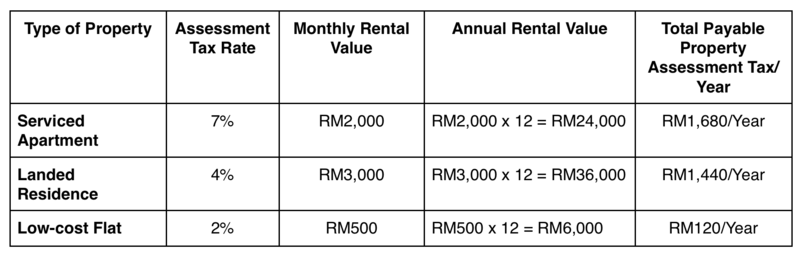

Property

assessment tax is evaluated based on the annual rental value of a

property set by the state government or local authority where the

property is located. Rates vary according to the type of property (eg:

residence, serviced apartment, small-office-home-office, flats),

location, market rate, and state of the property. (Note: Empty residential and commercial lands are also subjected to this tax.)

An example is as such (according to property assessment tax rates set by DBKL):

*Note: Property assessment tax is

payable in 2 instalments, which are on February 28 or 29 for the first

half of the year (January to June) and on/before August 31 for the

following half of the year (July to December).

4. Cukai Tanah (Quit Rent)

This form of tax is applicable to owners of land, either

freehold or leasehold and is an annual tax payable to the State

Governments of each individual state. The tax also applies to homeowners

of condominiums, apartments and other strata titles. The rates of quit

rent may vary between respective states and even within the same state.

It

is stipulated in The National Land Code that all payments of quit rent

must be made on/before May 31 every year. Individual landowners can pay

directly to the Department of Director General of Lands and Mines via

online banking while owners of strata titles will have to make payment

to the Joint Management Body (JMB) and Management Corporation (MC) of

their respective residences/property. The JMB and MC will then submit

the collective payment to the land office.

Calculating quit rent:

For example, a house measuring 40’ x 70’ or 2,800 sf:

Selling a Property

5. Real Property Gain Tax (RPGT)

Should you choose to sell your property within 5 years of its

purchase, RPGT will be imposed on the net chargeable gains that you get

from selling it. Which is the amount of profit leftover after deducting

permissible costs from the gross profit, such as legal fees, property

agent fees, repair costs etc.. (Note: Remember to keep all records and receipts of these deductibles.)

RPGT

is only imposable should the sale or disposal of a property be

profitable. If you do not turn a profit from the sale (eg: sold at same

price as purchase/lower than purchase price), there is no need to pay

for RPGT. Transfer of properties between married couples, a parent and

his/her child, grandparents to grandchildren, where there are no gains

or losses, is also exempted from RPGT. (Note: There is no exemption in transfers between siblings.)

Rates

for the RPGT varies according to the number of years from which the

property is disposed of or sold. There are also different rates for

Malaysians and Permanent Residents of Malaysia, non-Malaysians as well

as companies.

The RPGT was recently amended in the country’s 2015 Budget, whereby new rates are as follows:

Calculating RPGT:

For example, you

(a Malaysian) buy a property on October 1st 2011 at a price of

RM300,000. In October, 2016 you sell the same property for RM600,000.

Hence, the rate that will apply to you is 15% as it is the 5th year of

ownership.

*Note: Each individual is allowed a one-time

only exemption from RPGT in the disposal of a residential property. This

exemption is not applicable to commercial properties.

Taxing Effort Required of Property Owners

Despite

how taxing it may be to go about knowing which taxes apply to your

property, calculating how much tax you have to pay and even who to pay

to, paying taxes is the responsibility which comes with property

ownership.

Hence, owning a property takes more than just money,

it also takes effort and ample knowledge. It is hoped that this simple

guide can help property owners (especially first-time buyers or owners)

manoeuvre the overwhelming sea of stamp duties and GST to tackling the

waves of property assessment taxes and quit rent until finally, sailing

smoothly pass the Real Property Gain Tax (after 5 years that is).

***source PropSocial November 2016

Comments

Post a Comment